新闻动态

MORE

- [2024-03-02]必赢网址bwi437全体辅导员召开 “开学...

- [2024-02-29]关于召开新学期工作部署会议

- [2024-02-28]院领导深入课堂检查开学第一课

- [2024-01-25]关于开展2024年寒假送温暖活...

- [2024-01-18]必赢网址bwi437赴财通证券福建分公司开...

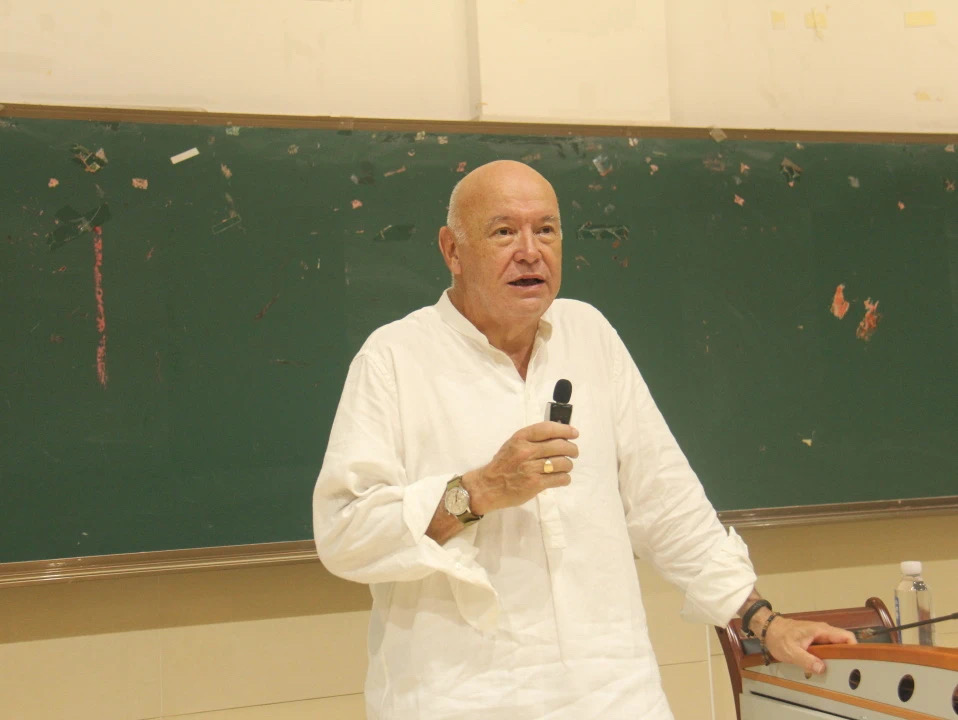

- [2024-01-18]必赢网址bwi437举办中外合作办学动画专...

- [2024-01-12]关于召开2024届毕业生就业工...

- [2024-01-08]必赢网址bwi437举办财通证券福建分公司...

雅思教学

MORE

学生工作

MORE

- 2024-03-02 必赢网址bwi437全体辅导员召开...

- 2024-01-25 关于开展2024年寒假...

- 2024-01-18 必赢网址bwi437举办中外合作办...

- 2023-12-26 必赢网址bwi437辅导员召开 “...

- 2023-12-20 关于召开校友访校座...

- 2023-12-19 团干部上讲台

- 2023-12-12 必赢网址bwi437全体辅导员召开...

管理系统登录